Sepetinizde ürün bulunmuyor.

payday loan with bad credit near me

How do Financial Prices Change the Housing market?

House Cost

When interest rates is higher, fewer Us americans can afford property. After all, being able to pay for a down-payment is only the start of buying a property. Prospective people should also learn they’ll be capable of making typical monthly installments having 30 years or so. High interest rates indicate higher month-to-month mortgage repayments and reduced client appeal.

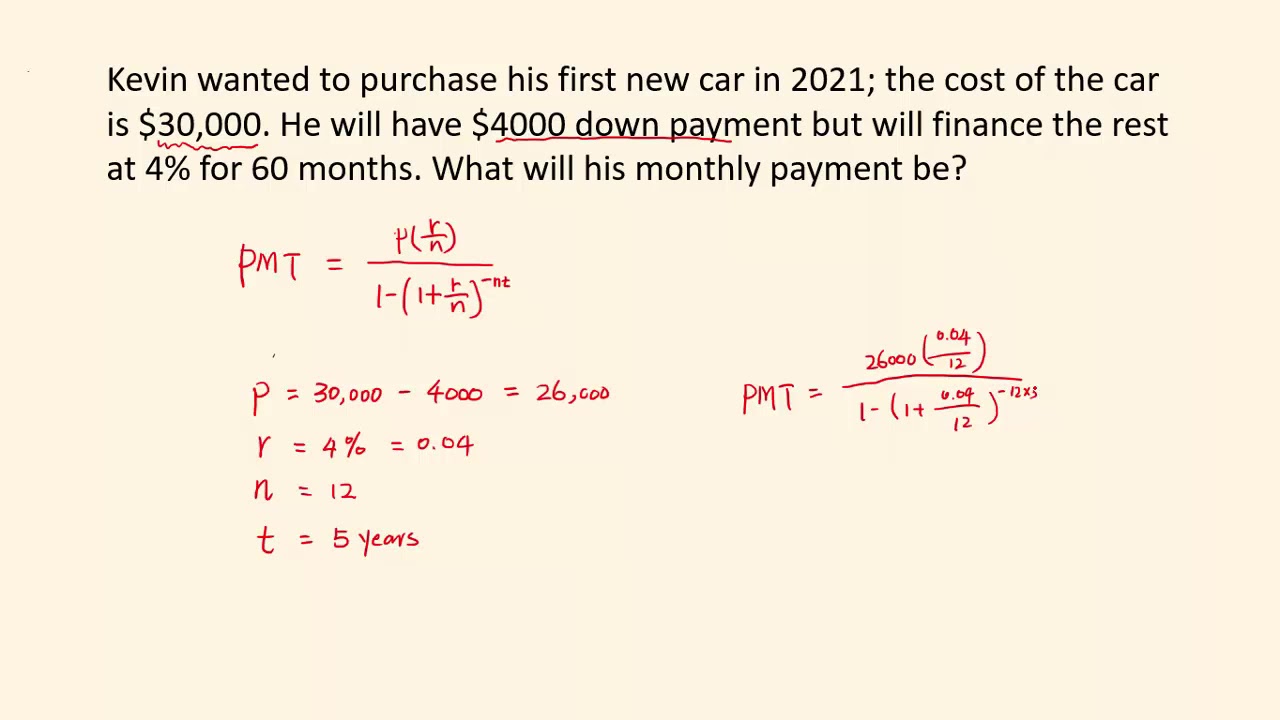

For example, if you are looking at a great $250,000 financial with a 3% Apr (regular for pre-pandemic moments) for three decades, the fresh payment would be more or less $step 1,. By the end of the home financing, you would keeps reduced $129, into the notice. However, that exact same mortgage having good seven% Apr (lower than the current mediocre) would want $step one, per month, as well as the total focus would balloon so you can $348,.

This type of variations helps make the prospect of purchasing property impractical and you can nearly impossible for most Us americans. Alternatively, an informed action to take will be to hold off and hope for the fresh costs to drop down.

Willingness To offer

Interest levels together with connect with homeowners’ determination to offer. Whenever home loan rates are highest, home providers may well not have to promote since they need buy a home with a high interest rates. Finally, they could find yourself taking a loss from their home conversion process.

The opposite will make property owners significantly more ready to offer. Low interest rates bring most recent people the opportunity to promote functions they not need and purchase better qualities to possess higher level rates and you will reduced fixed interest rates to possess three decades or higher.

You will need to understand that the increased interest rates do not go towards the people who own our home, nor will it automatically show an increase in their house equity. The general worth of the home remains the same; it is simply that the interest rate to have borrowing from the bank the principal try a lot higher. They receive the same amount of currency toward sales regarding your house because they would have prior to now, except now they will need certainly to feel elevated interest rates towards purchase of their brand new home and you will potentially generate losses regarding the techniques.

How can you Select Competitive Mortgage Pricing?

Because of the significance of mortgage costs for 2024 and you can beyond, you need to know how to discover competitive ones when the you’re looking to purchase a property, be it your first domestic or perhaps not.

Regional Business Mortgage Advantages

Luckily for us, Vaster helps you through the procedure all the time. We offer an extensive, supportive, one-avoid shop financial experience, enabling consumers as you to find the best mortgage choices situated on your own finances, credit score, or any other activities.

More to the point, you will be paired with an educated loan manager to include you with expert suggestions face to face. When you run Vaster, you are getting the brand new reassurance and monetary learn-the method that you must make certain good buy and mortgage.

Final thoughts

Sooner, these types of forecasts should never be invest stone, and differing economic issues or geopolitical developments you’ll feeling just how financial cost fluctuate throughout 2024. It’s also important to observe that costs may differ from borrower so you’re able to debtor and you will out-of mortgage tool to help you mortgage product. Still, you are able to such forecasts due to the fact instructions otherwise site points as the you run the realtor and home loan company to arrange to own homeownership.

Require far more information and professional suggestions? Contact Vaster and also started in your mortgage software with the individual money professionals who help aid you in order to find the right coverage, also a prospective financial refinance, that fits your position.

Vaster try an equal chance lender. The newest cost and terms and conditions stated in this article are not good dedication to give. NMLS 180495.

National Relationship of Realtors: 6.3%

Even if the interest levels lose less than seven% on the last half out-of 2024, that’s likely not likely to be sufficient to own earliest-day people Blue Mountain installment loan with savings account to pay for a beginning domestic. Wage increases have not leftover up with the roaring will set you back regarding mortgage loans, and several individuals are expected to will still be clients rather than people. Because of this, that it reveals the doorway to help you overseas buyers and you can businesses trying to change single-family members property with the leasing qualities.

Brand new Provided still has several possibilities leftover in 2023 to boost the brand new prices because they has actually previously. Criterion are you to definitely a beneficial November walk is impractical, however, numerous positives expect the newest December meeting usually give a growth off 0.twenty-five fee situations. If that happens, it does most likely reduce the credit speed and affect desire pricing.